The director’s commentary track for Daring Fireball. Long digressions on Apple, technology, design, movies, and more.

…

continue reading

محتوای ارائه شده توسط LessWrong. تمام محتوای پادکست شامل قسمتها، گرافیکها و توضیحات پادکست مستقیماً توسط LessWrong یا شریک پلتفرم پادکست آنها آپلود و ارائه میشوند. اگر فکر میکنید شخصی بدون اجازه شما از اثر دارای حق نسخهبرداری شما استفاده میکند، میتوانید روندی که در اینجا شرح داده شده است را دنبال کنید.https://fa.player.fm/legal

Player FM - برنامه پادکست

با برنامه Player FM !

با برنامه Player FM !

“Many prediction markets would be better off as batched auctions” by William Howard

Manage episode 498318478 series 3364760

محتوای ارائه شده توسط LessWrong. تمام محتوای پادکست شامل قسمتها، گرافیکها و توضیحات پادکست مستقیماً توسط LessWrong یا شریک پلتفرم پادکست آنها آپلود و ارائه میشوند. اگر فکر میکنید شخصی بدون اجازه شما از اثر دارای حق نسخهبرداری شما استفاده میکند، میتوانید روندی که در اینجا شرح داده شده است را دنبال کنید.https://fa.player.fm/legal

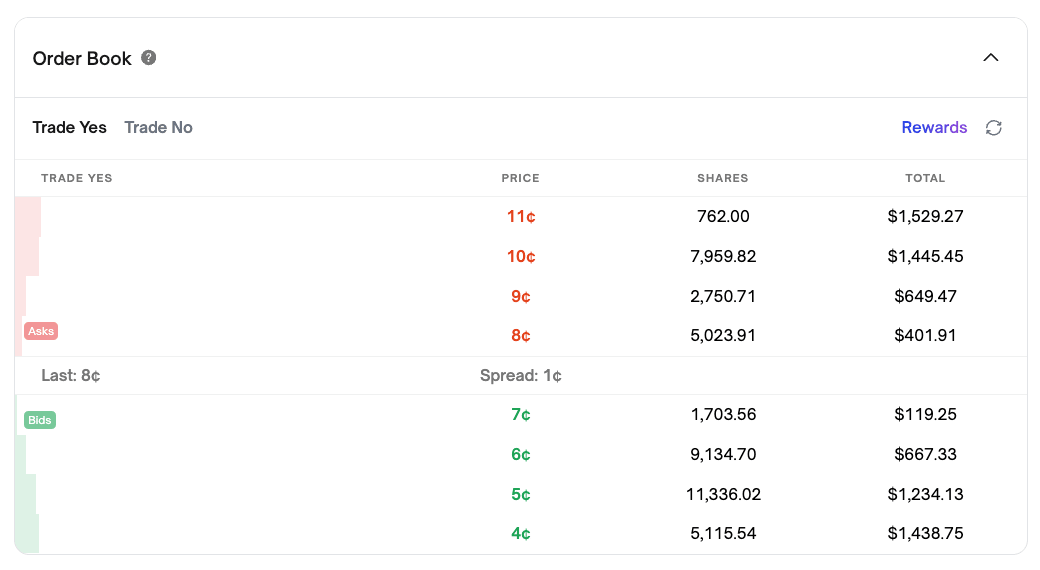

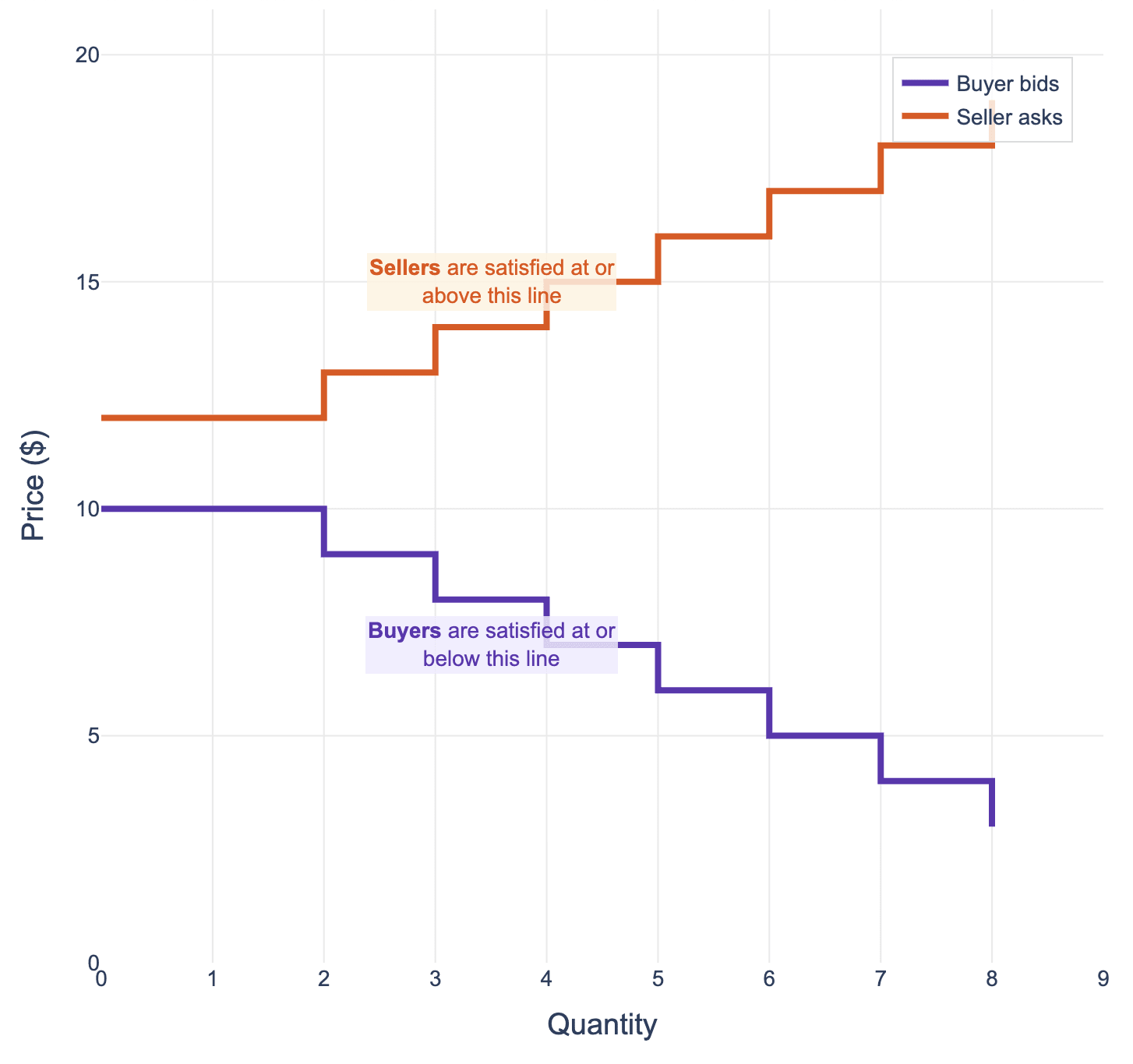

All prediction market platforms trade continuously, which is the same mechanism the stock market uses. Buy and sell limit orders can be posted at any time, and as soon as they match against each other a trade will be executed. This is called a Central limit order book (CLOB).

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

…

continue reading

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

625 قسمت

Manage episode 498318478 series 3364760

محتوای ارائه شده توسط LessWrong. تمام محتوای پادکست شامل قسمتها، گرافیکها و توضیحات پادکست مستقیماً توسط LessWrong یا شریک پلتفرم پادکست آنها آپلود و ارائه میشوند. اگر فکر میکنید شخصی بدون اجازه شما از اثر دارای حق نسخهبرداری شما استفاده میکند، میتوانید روندی که در اینجا شرح داده شده است را دنبال کنید.https://fa.player.fm/legal

All prediction market platforms trade continuously, which is the same mechanism the stock market uses. Buy and sell limit orders can be posted at any time, and as soon as they match against each other a trade will be executed. This is called a Central limit order book (CLOB).

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

…

continue reading

Example of a CLOB order book from Polymarket Most of the time, the market price lazily wanders around due to random variation in when people show up, and a bulk of optimistic orders build up away from the action. Occasionally, a new piece of information arrives to the market, and it jumps to a new price, consuming some of the optimistic orders in the process.

The people with stale orders will generally lose out in this situation, as someone took them up on their order before they had a chance to process the new information. This means there is a high [...]

The original text contained 3 footnotes which were omitted from this narration.

---

First published:

August 2nd, 2025

Source:

https://www.lesswrong.com/posts/rS6tKxSWkYBgxmsma/many-prediction-markets-would-be-better-off-as-batched

---

Narrated by TYPE III AUDIO.

---

625 قسمت

همه قسمت ها

×به Player FM خوش آمدید!

Player FM در سراسر وب را برای یافتن پادکست های با کیفیت اسکن می کند تا همین الان لذت ببرید. این بهترین برنامه ی پادکست است که در اندروید، آیفون و وب کار می کند. ثبت نام کنید تا اشتراک های شما در بین دستگاه های مختلف همگام سازی شود.